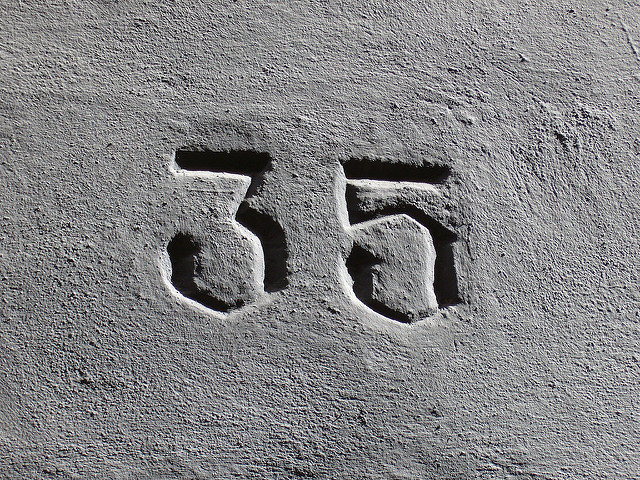

Lengthier mortgage terms on the rise for potential buyers

As properties become less affordable for prospective buyers, the number of applications for 35-year mortgages are increasing dramatically.

For many first-time buyers in today’s housing market, the ability to secure a mortgage by raising the necessary funds for a deposit is considered a major triumph. However, with ever-increasing prices, the crowning achievement of becoming a homeowner is slowly turning into a pyrrhic victory.

For decades, the longest mortgage term for the majority of buyers stood at 25 years, with many new owners opting for even shorter terms. For those in low paying jobs, however, certain banks began offering potential purchasers the option of a 35-year mortgage in an effort to encourage borrowing and further their profits.

As late as 2006, the percentage of mortgages with 35-year terms still stood at a minimal 13.8%. But by 2016, that number had sky-rocketed to a shocking 30% according to new figures released by the Financial Conduct Authority under the Freedom of Information Act,

Experts within the industry believe that this research reinforces the idea that home ownership is becoming an increasingly exclusive club. And even those who are able to buy are finding themselves at a marked financial disadvantage compared to those who bought a decade previously.

The issue is not just isolated to first-time buyers either. More than seven in ten mortgage brokers have disclosed that there has been a stark increase in demand for 35-year loans in recent years.

On average, the percentage of all mortgages with a 35-year term across the country reached 13.5% in 2016, an increase of 9.7% since 2006.

“The majority of brokers (62%) and lenders (68%) agree that longer term mortgages are an essential option for aspiring homeowners and would argue that this is a response to reality and remains responsible lending,” said Peter Williams, executive director of the Intermediary Mortgage Lenders Association.

“However, this in no way lets the government off the hook in needing to act swiftly to address the housing crisis.”

Due to a lack of new-build homes, high purchase prices and minimal wage growth, these figures suggest that the housing market could ultimately reach a point in the future where it is inaccessible to potential first-time buyers.

This is also bad news for any current homeowners who are looking to sell their house fast, as any reduction in the number of new buyers entering the market limits the likelihood of an efficient sale within a reasonable timeframe, and this subsequent lack of activity could conceivably lead to a weakened economy.

Need to sell? Fast? Why not ask National Homebuyers for advice, as we buy any house. Call 08000 443 911 or request a call back to find out how much you could get for your property.